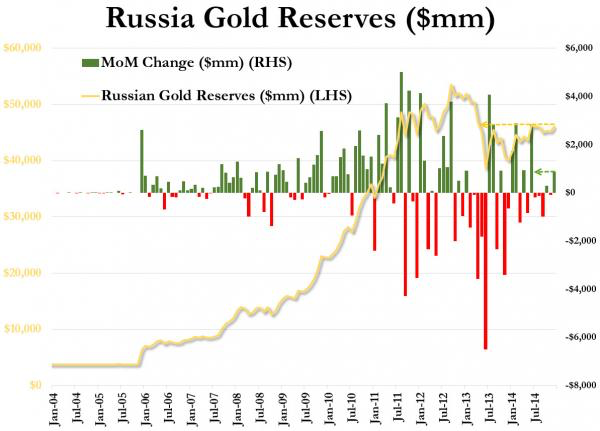

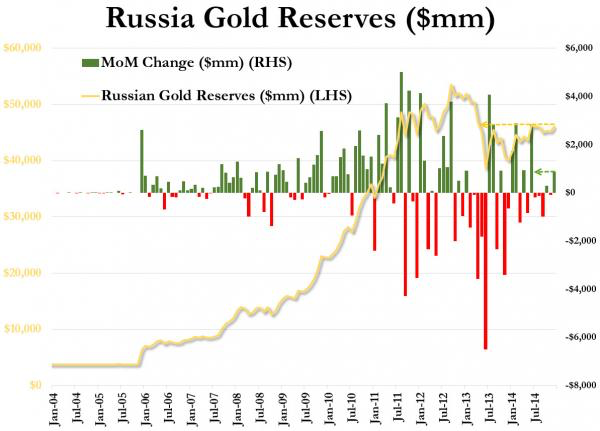

The rumors of Russia selling its gold reserves, it is now clear, were greatly exaggerated as not only did Putin not sell, Russian gold reserves rose by their largest amount in six months in December to just over $46 billion (near the highest since April 2013). It appears all the "Russia is selling" chatter did was lower prices enabling them to gather non-fiat physical assets at a lower cost. On the other hand, there is another trend that continues for the Russians - that of reducing their exposure to US Treasury debt. For the 20th month in a row, Russia's holdings of US Treasury debt fell year-over-year - selling into the strength.

Buying low...

Russia gold reserves jump the most in six months in December, near the highest since April 2013...

and selling high...

Russian holdings of US Treasuries are now at the 2nd lowest since 2008...

It would appear the greatest rotations that no one is talking about are the fiat to non-fiat and the paper to physical shifts occurring in China and Russia.

Charts: Bloomberg

Some have commented on the "unprecedented" capital flight from Russia, but as Dr. Constantin Gurdgiev explains - Western 'analysts' appear to have forgotten a few things...

Central Bank of Russia released full-year 2014 capital outflows figures, prompting cheerful chatter from the US officials and academics gleefully loading the demise of the Russian economy.

The figures are ugly: official net outflows of capital stood at USD151.5 billion - roughly 2.5 times the rate of outflows in 2013 - USD61 billion. Q1 outflows were USD48.2 billion, Q2 outflows declined to USD22.4 billion, Q3 2014 outflows netted USD 7.7 billion and Q4 2014 outflows rose to USD72.9 billion. Thus, Q4 2014 outflows - on the face of it - were larger than full-year 2013 outflows.

Complete story at - "De-Dollarization" Deepens: Russia Buys Most Gold In Six Months, Continues Selling US Treasuries | Zero Hedge

Buying low...

Russia gold reserves jump the most in six months in December, near the highest since April 2013...

and selling high...

Russian holdings of US Treasuries are now at the 2nd lowest since 2008...

It would appear the greatest rotations that no one is talking about are the fiat to non-fiat and the paper to physical shifts occurring in China and Russia.

Charts: Bloomberg

Some have commented on the "unprecedented" capital flight from Russia, but as Dr. Constantin Gurdgiev explains - Western 'analysts' appear to have forgotten a few things...

Central Bank of Russia released full-year 2014 capital outflows figures, prompting cheerful chatter from the US officials and academics gleefully loading the demise of the Russian economy.

The figures are ugly: official net outflows of capital stood at USD151.5 billion - roughly 2.5 times the rate of outflows in 2013 - USD61 billion. Q1 outflows were USD48.2 billion, Q2 outflows declined to USD22.4 billion, Q3 2014 outflows netted USD 7.7 billion and Q4 2014 outflows rose to USD72.9 billion. Thus, Q4 2014 outflows - on the face of it - were larger than full-year 2013 outflows.

Complete story at - "De-Dollarization" Deepens: Russia Buys Most Gold In Six Months, Continues Selling US Treasuries | Zero Hedge

No comments:

Post a Comment

All comments subject to moderation.